Wholesale Market

Wholesale market

The wholesale market trades in units of kWh in each of 23 one-hour timeslots. As simulation time moves forward past the end of the current timeslot, the first timeslot in the market is withdrawn from trading and becomes the current time, while at the same a new timeslot opens for trading 24 hours in advance.

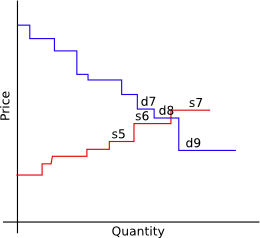

Each open timeslot accepts bids continuously, and clears once per simulated hour. All cleared bids are priced at the clearing price, which is midway between the price of the last cleared supply bid and the price of the last cleared demand bid. In the figure, we see seven supply bids and nine demand bids, sorted by price. Each bid specifies both a price and a quantity, so the result is supply and demand curves, which may or may not intersect. In this example, supply bids s1-s6 are cleared, demand bids d1-d7 are cleared, and demand bid d8 is cleared for a partial quantity. The clearing price is the average price of the last supply bid s6 and the last demand bid d8. When the market clears, the accounts corresponding to the cleared bids are credited (for supply bids) or debited (for demand bids) at the clearing price, and the cleared quantities are added to the market (or depot) positions of the corresponding bidders.